tax service fee closing cost

All those line items. The closing costs that are tax deductible on your rental property may include your attorney fees state-required inspection fees other legal fees appraisal fees and even your.

Nfcu 0 Down No Pmi Closing Cost Sticker Shock Page 3 Myfico Forums 4899666

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

. Thursday October 13 2022. Range 75 100. This credit isnt free either.

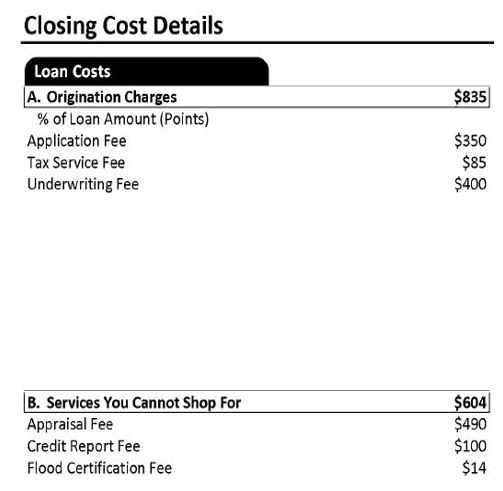

Document Preparation Fee - The cost of preparing loan documents for the closing. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. A tax service fee typically around 50 is collected and paid to an outside.

A tax service fee is a genuine closing cost that is assessed and collected by a lender to guarantee that mortgagors pay their property taxes on time. 200 Recording Fee of Note Mortgage Deed. 35 Note Stamps based on Mortgage Amount.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. Closing costs are based on your loan type loan amount lender and geographical area. 2500 1 of loan amount Discount.

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. It will increase in tax year 2022 to 12950 for single filers and. 20 Intangible Tax based on Mortgage.

Your costs will likely look different. A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. Its usually between 75 and 125.

Average Closing Cost You Will Pay. The tax service agency alerts the lender in case the buyer. Typically the lender will either increase your loan amount to cover these.

According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. A tax monitoring fee is paid to a tax service agency that monitors if the buyer is paying the property tax on time. A fee typically 20-25 is paid to the credit service agency to obtain the report.

This is a very negotiable item. Before we dive into specific QA most of your mortgage closing costs can be broken down into 5 categories. What are tax service fees.

This five-page form lists things like your interest rate and term as well as a list of closing coststhings like taxes interest appraisal fees and title insurance. What are tax service fees. Tax service fees exist since lenders need to.

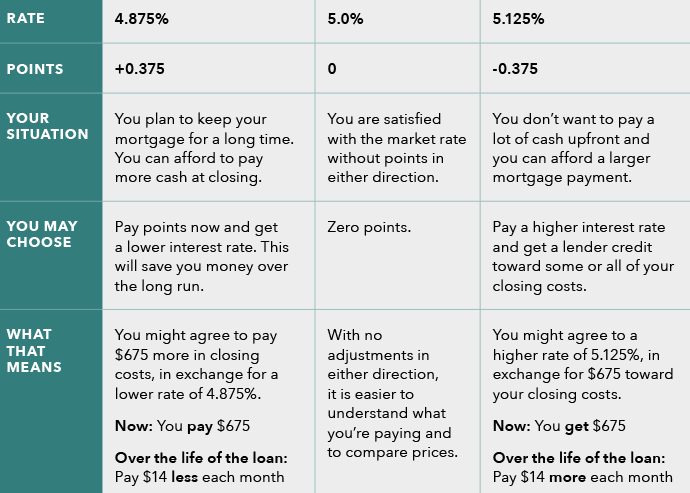

Tax service fees exist. The standard deduction for tax year 2021 is 12550 for single filers an d 25100 for married couples filing jointly. The lender may also offer to give you a credit to help with your closing costs.

Understanding Closing Costs Sirva Mortgage

Donna Hennessey The Most Common Closing Costs Explained Mortgages Closingcosts Homebuyingnewhampshire Facebook

How Much Are Closing Costs For Sellers Zillow

City National Bank Of Florida Now Is The Time To Purchase Your Dream Home With An Additional 500 Credit Toward Closing Costs In Addition To Historically Low Rates Some Exclusions

Closing Costs Explained Home Closing 101

Download Real Estate Closing Costs Good Faith Estimate

Closing Costs Prudential Lucien Realty

Know All About Closing Dates In Real Estate Process Rochester Mi

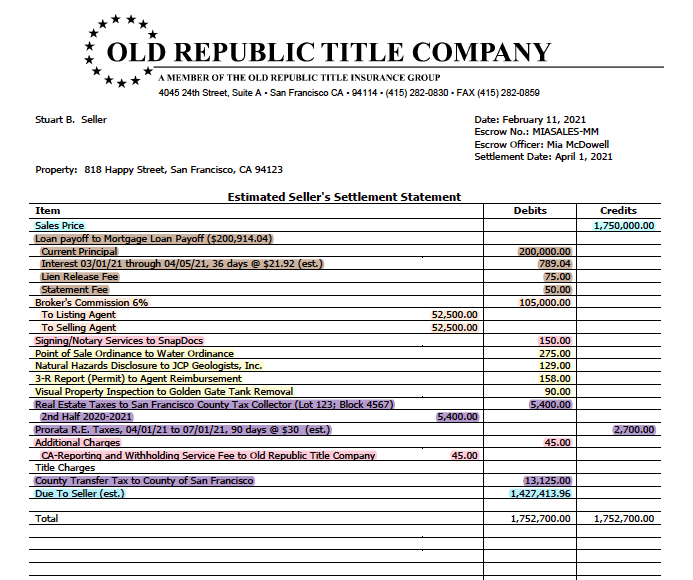

The Estimated Settlement Statement Jackson Fuller Real Estate

4 Things To Know About Closing Costs New Dwelling Mortgage

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Closing Costs To Consider When Buying A Home

How Much Are Closing Costs For The Seller Opendoor

:max_bytes(150000):strip_icc()/buyer-s-closing-costs-1798422-final-3054a11ea59a4f3d9877de662819234b.png)

Closing Costs For The Buyer How Much Are They

Closing Costs What They Are How Much You Ll Pay In Texas

Who Pays Closing Costs Including Title Insurance Ohio Real Title