how much tax to pay on gambling winnings

When you win a gambling win with a legal operator before giving you your winnings the operator will deduct 24 of the total taxes and provide you with a copy of the IRS. Gambling and lottery winnings are taxed at your ordinary income tax rate according to your tax bracket.

Las Vegas Casino Win Loss Statement Vegashowto Com

But every time sportsbooks lose a 1100 bet they only lose 1000.

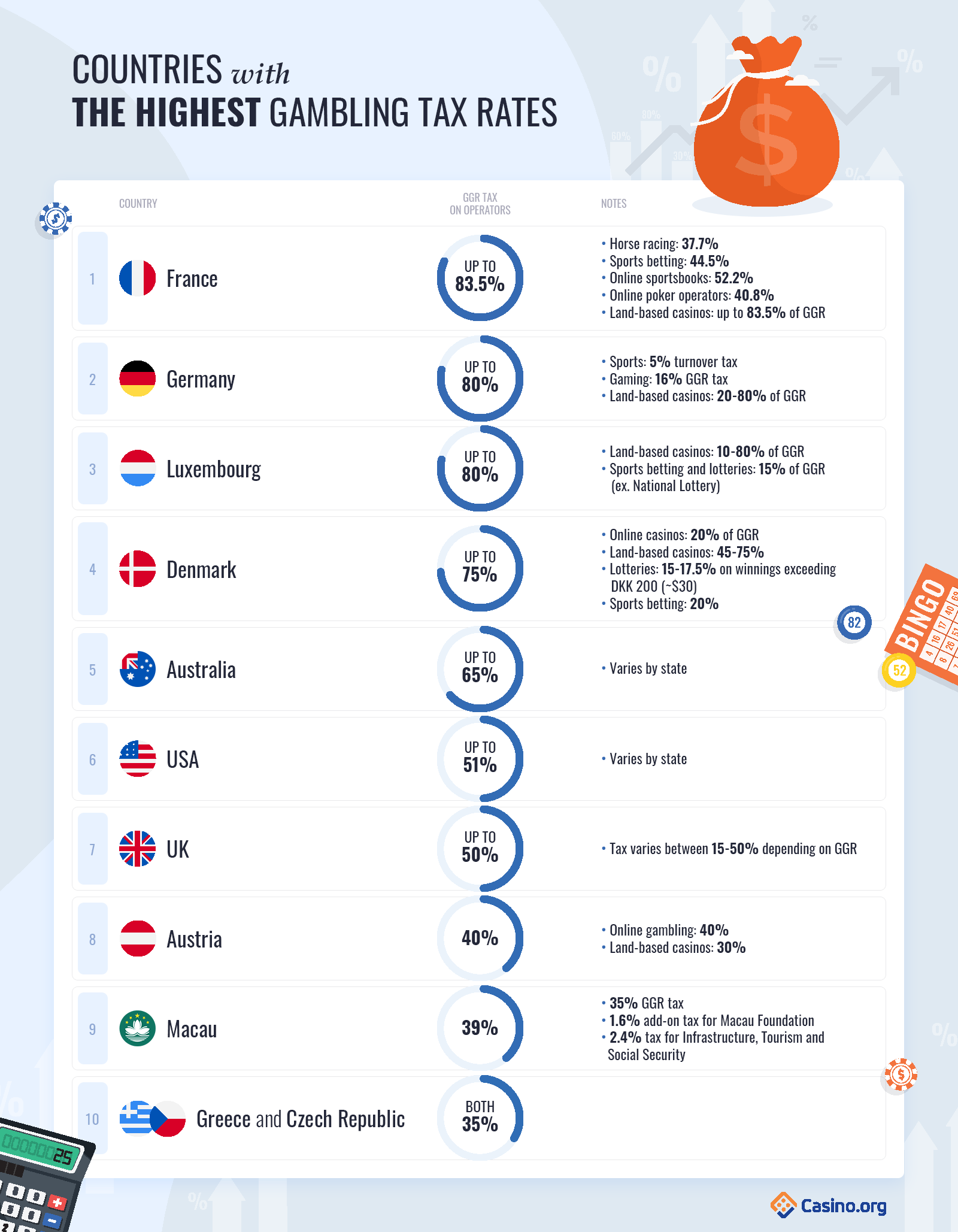

. California sets several income thresholds and. This will itemize your gambling income. The answer to this question depends on the country in which you are gambling.

This is especially true when you net a big win and receive a W-2G. As for state taxes in Ohio you report gambling. On your federal form you submit this as other income on Form 1040 Schedule 1.

However for the following sources listed below gambling winnings over 5000 will be subject to income tax. If gambling winnings are received that are not subject to tax withholding you may have to pay estimated tax. How Much Taxes Do I Pay On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money.

Gambling winnings are typically subject to a flat 24 tax. You have to wonder how professional a gambler they. Your gambling winnings are generally subject to a flat 24 tax.

In New York state tax ranges from a low of 4 to a high of 882. That means when Missouri residents pay their state income taxes they need to be aware they should report. Like most states Missouri considers gambling winnings taxable income.

Yes you do need to pay federal taxes on gambling winnings in the United States. Organizations withholding Michigan income tax on gambling winnings must register with the Treasury Department using Form 518. So if a bettor makes 10 wagers of 1100 each and.

That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings but on your entire personal income. The higher your taxable income the higher your. A tax will be withheld.

Whats the tax rate on gambling and lottery winnings. There are two types of withholding of gambling winnings. If you win more than 600 on the state lottery or a casino the operator in question should automatically withhold 24 of your prize to cover federal tax.

Every time bettors lose a 1100 bet they lose 1100. Ill cut right to the chase. Not sure how much to pay.

For online casino and online poker services general sales tax law applies and gross gaming revenues the amount wagered by the players minus the winnings paid out are taxed at 19. However for the activities listed below winnings over 5000 will be subject to income tax withholding. Professional gamblers with less than 20000 of reported income only pay 10 on their winnings a tax savings of 14.

In the United States for example you would pay federal taxes on your winnings but the tax rate. Gambling winnings are subject to a 24 federal tax rate.

What You Need To Know About Taxes On Gambling Winnings Ageras

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Are Gambling Winnings Taxable Natural8 Blog

Guide To Irs Form W 2g Certain Gambling Winnings Turbotax Tax Tip Video Youtube

Taxes On Casino Winnings How Much Should You Pay

Sports Betting And Taxes Paying Taxes On Your Sports Betting Winnings

Avoid The Gambling Winnings Tax Surprise Proactive Personal Prompt

How To Pay Taxes On Sports Betting Winnings Losses

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

What You Should Know About Taxes On Gambling Winnings Tax Resolution Attorney Blog August 26 2020

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Taxes On Gambling Winnings A Complete Guide

States With The Lowest Gambling Taxes Us Casino Winnings Tax

How To Use The W 2g Tax Form To Report Gambling Income Turbotax Tax Tips Videos

North Carolina Gambling Taxes How Are Winnings Taxed In Nc

Gambling Winnings Income Taxes Bovegas Blog

How Are Gambling Winnings Taxed

Gambling And Taxes What You Should Know 800 Gambler 800gambler Org